DELAWARE STATUTORY TRUST (DST)

Guide

Delaware Statutory Trusts are widely used to structure 1031-compatible commercial real estate offerings. These DST-structured offerings can be very valuable to 1031 investors, which is why we have developed this comprehensive guide on every aspect of DSTs as they are used in commercial real estate.

In this guide, we explain the advantages and disadvantages of investing with a DST in terms of details about the legal structure of DSTs, how they are treated by the I.R.S., and aspects of the DST real estate market.

What is a Delaware Statutory Trust (DST)?

A Delaware Statutory Trust (DST) is a legal entity used to arrange for the co-ownership of property. Given a DST’s legal structure, co-owners are entitled to profits earned from the property (such as rent) without any management responsibilities, making DSTs advantageous in constructing multi-investor commercial real estate offerings.

WHAT ARE THE PROS AND CONS OF USING A DST?

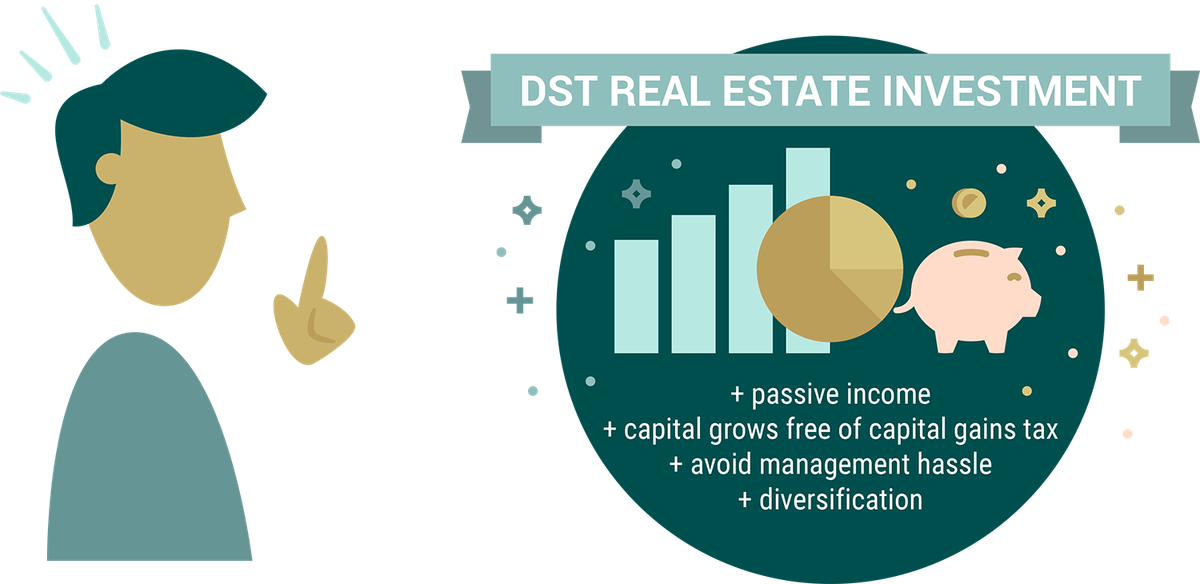

The pros of DST-structured investments: they are 1031-compatible investments that provide passive cash flow without any management obligations for the investor.

The cons of DST-structured investments: they are long-term, illiquid investments in which the investor has little control over asset management.

WHY DELAWARE?

There are many reasons that Delaware Statutory Trusts are highly-regarded in the industry, but two stand out. First, statutory trusts formed in accordance with the Delaware Statutory Trust Act (DSTA) are the only trusts that are explicitly recognized as 1031-compatible by the IRS.

And second, the DSTA was written to allow unencumbered freedom of contract, making DSTs well-suited for large-scale investments in diverse high-quality assets.

Chapter 1

Why Are DSTs So Valuable for 1031 Exchange Investors?

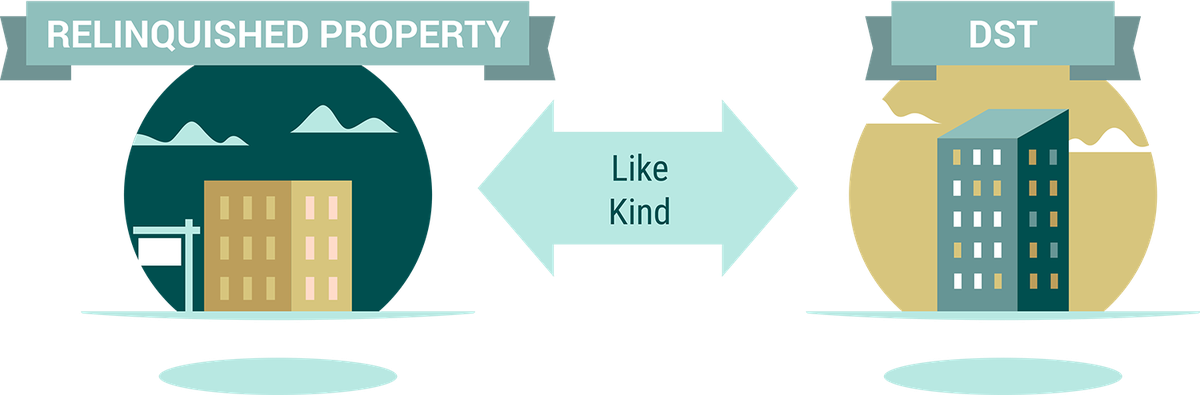

DST shares are regarded by the IRS as “like kind” with real property, making DST investments 1031-compatible. Unlike ordinary exchanges, however, investors are not burdened with any management obligations for their replacement properties, which instead are assumed by the DST’s trustee.

Let’s say you own an investment property which has appreciated in value and you’d like to transfer your capital into new investments. In deciding what to do, you may be pulled in different directions.

On the one hand, you’d like for your investment capital to grow unimpeded by capital gains taxes. You might also be accustomed to the cash flow that real estate can provide. This speaks in favor of deferring your capital gains taxes by reinvesting your capital into like-kind real estate as part of a 1031 exchange.

On the other hand, you might be hesitant to reinvest in real estate because you are tired of the hassles that come with being a landlord. You might also want to diversify rather than tying your capital to just one or two individual investment properties. This could make it tempting to realize your capital gain and pay the taxes.

Need DST Recommendations?

Connect with a specialist from our advisor network today.

So what do you do?

Sidestep the capital gains taxes, or sidestep the management hassle?

Stick with the passive cash flow, or move into a more diversified investment?

Luckily, you don’t have to choose. There is an increasingly popular real estate investment structure that can satisfy these different needs all at once: the Delaware Statutory Trust (or a “DST”).

The basic investment strategy works like this:

First, making use of IRC Section 1031, you exchange the proceeds from the sale of your original property for an interest in a DST, which itself owns many high-quality commercial properties. Alongside other investors, you yourself come to own a fractional interest in these properties[1].

Unlike directly owning real estate, by owning this interest via your DST-structured investment, you pass the burdens of management on to the sponsor, who acts as a trustee. Given the way that DSTs are treated by the IRS, acquiring this interest can satisfy the 1031 exchange requirements, helping you successfully defer capital gains taxes.

Reinvesting your capital by acquiring an interest in a DST therefore can give you a well-diversified and passive income-producing investment that enables you to defer capital gains taxes on the sale of your original property.

That’s the gist of how DSTs are often used in real estate investing. In the rest of this guide, we’ll dive into detail about what it is about DSTs that make them so useful in structuring your real estate investment.

Chapter 2

What Are the Key Benefits of DSTs?

Delaware Statutory Trusts (DSTs) are useful in real estate investing in large part due to their particular legal characteristics. By understanding a few details about the basic structure of DSTs, we can see how they come to have the beneficial features that they do.

WHY TRUSTS?

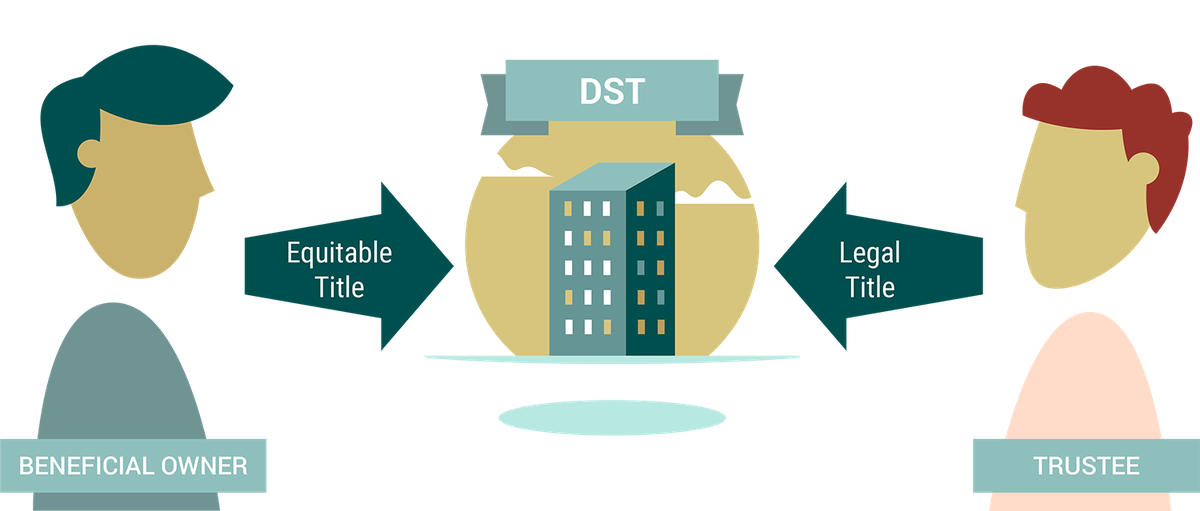

With the trustee/beneficiary distinction inherent to trusts, beneficial owners take equitable title to a DST’s assets, while the trustee (sponsor) is responsible for managing those assets. Beneficiaries benefit, trustees manage.

DSTs are a particular kind of trust. Like any trust, DSTs distinguish between two main parties: a trustee who manages a particular property and a beneficiary (or “beneficial owner”) who benefits from that property.

This division in roles comes with a division in different kinds of ownership.

In a common law trust, the trustee and the beneficial owner count as owning the property in different senses:

- the trustee takes legal title, for the purposes of management

- beneficial owners take equitable title, for the purpose of raking in benefits.

Though DSTs differ from common law trusts in some important ways, they share a key feature of all trusts: investors in a DST hold equitable title to the properties held by the DST. This makes them unlike stockholders in a corporation, who do not themselves count as owning the properties owned by the corporation.

DSTs are “pass-through entities”: although the investors do not hold legal title to a DST’s properties, for federal tax purposes they are treated as owning (a fractional interest in) that property. This entitles them to receive their pro-rata share of the income, appreciation, and tax benefits derived from the DST’s holdings.

The “pass-through” status of DSTs is key to their eligibility for use in 1031 exchanges. To qualify for a 1031 exchange, proceeds from a property’s sale must be invested in a “like-kind” property[1]. By investing in a DST that holds title to investment property, the investor is therefore recognized as acquiring property of “like kind” to their sold real estate[2].

The division of roles between trustees (sponsors) and beneficiaries (investors) is also a central part of what makes DSTs well-suited to provide passive income to investors.

Investors are beneficial owners in the DST, whereas the sponsor who acquires, packages, and offers the investment is its trustee. As part of the agreement which creates the DST (it’s “governing instrument”), the sponsor is responsible for managing the properties held by the trust.

Unlike other multi-investor real estate arrangements, the trustee/beneficiary distinction inherent to trusts ensures that DST-structured investments are truly passive. Alternative arrangements sometimes achieve a degree of passivity by using a property manager, but investors in DST-structured offerings are never left with management or business responsibilities of any sort.

WHY STATUTORY TRUSTS?

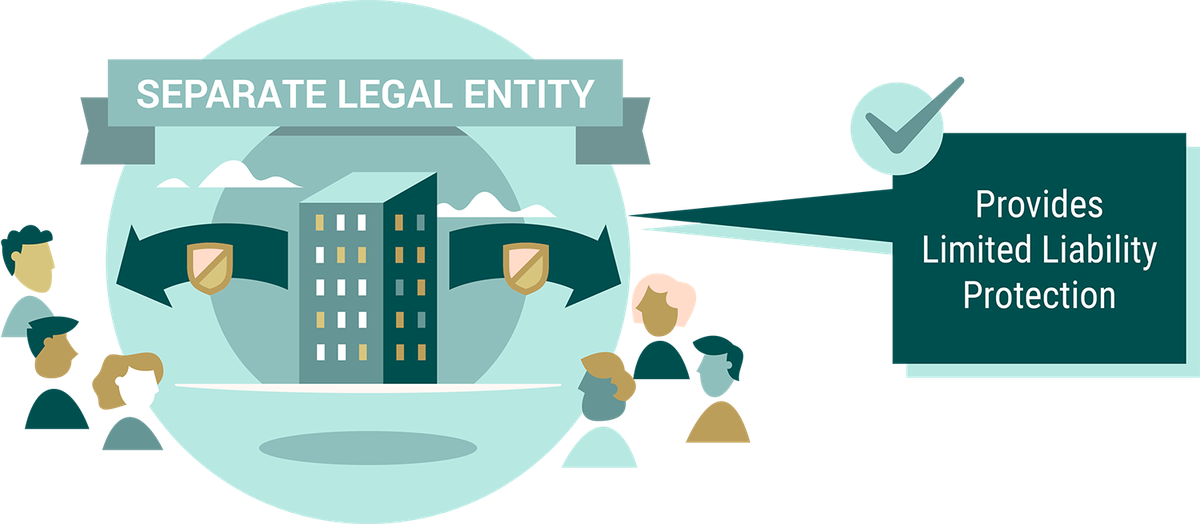

Statutory trusts are distinguished as separate legal entities from their trustees and beneficial owners. This helps to provide limited liability to beneficial owners, protecting them from the liabilities of other owners and the liabilities of the DST itself.

That DSTs are statutory trusts provides them with further nice features for real estate investment.

A statutory trust, unlike a common law trust, is created in accordance with the guidelines of a particular statute. DSTs specifically are created under the Delaware Statutory Trust Act (DSTA), which explicitly states what rights and obligations the parties to DSTs have.

As is made clear in the DSTA, DSTs are separate legal entities from their trustees or beneficial owners.

Given that a DST is a separate legal entity, any debts incurred by the DST cannot put an investor’s personal assets in jeopardy[3]. The DSTA makes explicit that beneficial owners of a DST have the same limited liability protection as stockholders in a private corporation.

Similarly, lenders to individual investors in a DST do not have the right to obtain possession of the DST’s property---DSTs are “bankruptcy remote”.

So, although beneficial owners of a DST are each regarded as owning fractions of the DST’s property for income, appreciation, and tax purposes, the separate legal status of the statutory trust allows for provisions which protect investors from the liabilities of the other owners and of the DST itself.

WHY DELAWARE?

Statutory trusts formed in accordance with the Delaware Statutory Trust Act (DSTA) are the only trusts that are explicitly recognized as 1031-compatible by the IRS.

The DSTA was written to allow unencumbered freedom of contract, making DSTs well-suited for large-scale investments in diverse high-quality assets.

One reason why Delaware Statutory Trusts in particular have been popular for real estate investing is simply that Delaware was the first state to enact code governing statutory trusts. Sometimes, “We’ve been doing it this way” is a reason to keep doing it this way.

But the DSTA is also just good law.

The Act is so widely admired as a piece of legislation that it was taken as the model of the Uniform Statutory Trust Act[4]. The USTA has in turn been adopted by Washington D.C. and Kentucky. So, in principle one could use a Kentucky Statutory Trust to arrange a large multi-investor, multi-property real estate investment, but it’s not clear that one should. There are still stronger reasons to use DSTs for this purpose.

DSTs are the only statutory trusts to be explicitly recognized by the IRS as legal entities that can facilitate a 1031 exchange[5]. This is reason enough to use a DST-structured real estate investment if you are looking to reinvest capital from a current investment property.

But the explicit recognition by the IRS of DSTs as vehicles used for 1031 exchanges also is further accompanied by special federal instructions on how the trust must be organized and managed.

These IRS-imposed regulations create a positive environment for investors in at least two ways.

First, for a beneficial interest in a DST to qualify as a replacement property in a 1031 exchange, the DST’s governing instrument must ensure that beneficial owners benefit from the DST’s profits. One way the DST must do so is by distributing its profits to investors on a quarterly basis (and sponsors often make these distributions monthly).

Since sponsors often strive to design DST investment offerings to appeal to investors who are completing 1031 exchanges, many DST-structured real estate investments are deliberately designed to give investors passive cash flow from the DST’s profits.

Second, if you are investing with a DST that meets the IRS’s conditions for 1031 exchanges, the individual properties held by the trust have the potential to be comparatively reliable assets. Since the IRS requires that a DST used in a 1031 exchange cannot renegotiate any leases unless a tenant defaults, such DSTs are best used for holding large industrial or commercial single-tenant properties.

If a DST takes ownership of a large multi-tenant property such as an apartment complex, the DST can use a master lease structure whereby the DST leases to one party (who must provide certain regular cash flow) who then subleases the property to individual tenants in the complex. Given the kinds of tenants who are best suited for non-renegotiable leases, DST-structured real estate investments can prove more stable than investors may normally have access to.

Delaware enacted the DSTA expressly to provide parties to a trust with a high degree of freedom of contract. Given the minimal restrictions on DST governing instruments, there is no cap on how many beneficial owners a DST can have, so there is no limit to how many investors may contribute funds and take an interest in a DST. This helps sponsors to finance a wide range of commercial properties.

Although the total value of the properties in many DST offerings reach many millions of dollars, the minimum interest purchase price for individual investors can remain relatively low, around one hundred thousand dollars or less.

You can sometimes also find sponsors who use a particular DST to hold several high-quality properties, increasing the stability of the overall investment.

This stability is further protected by Delaware law, since investors who purchase an interest in a DST each own an undivided interest in the properties taken together, rather than owning an interest in a specific property of the trust.

When you buy an interest in a DST, you don’t just count as owning one of the many properties held by the trust; your passive income comes from your fractional interest in the whole collection of properties treated as one big asset. This bolsters the stability of your DST investment since neither the equity in the investment nor the passive income generated by it are tied to one particular property. For example, if one property held by the DST were to lose a tenant for a time, this need not altogether prevent you from receiving passive income from your investment.

Chapter 3

What Are the Potential Risks of DSTs?

One of the major benefits of investing in commercial real estate by acquiring shares in a DST is that this kind of investment structure helps to mitigate certain risks associated with real estate investing. But no investment is risk free.

HOW CAN A DST MITIGATE THE RISKS OF REAL ESTATE INVESTMENT?

Any real estate investment is subject to macroeconomic risks.

If the real estate market or the whole economy takes an economic downturn, then rents can decrease or your asset can appreciate more slowly. DSTs are helpful for protecting against such risks because they can offer investors access to portfolios of real estate which are diversified and which have high-quality tenants. They do this by being able to pool the resources of many investors at once while giving each investor limited liability protection.

WHAT KINDS OF RISKS COME WITH INVESTING IN A DST?

Investing in real estate using a DST comes with its own particular risks.

Here we’ll consider four general kinds of risk which DST investments are subject to: illiquidity risks, management risks, financing risks, and risks about the compatibility of such investments with investors’ ability to execute 1031 exchanges.

ILLIQUIDITY RISKS

A first risk that investors should be aware of is that capital invested into a DST is illiquid.

This is a standard risk of real estate investment. Whereas you can sell a share of stock in a day, if you try to convert personally-owned real estate investment property to cash, it can take a few months.

DST investments, however, are even less liquid.

Due to the strict trust agreement between the trustees and the investors in the DST, you won’t be able to access the funds which you contribute during the agreed holding period (the time during which the DST will hold onto its purchased real estate). This period can last anywhere between 7 and 15 years. While DSTs do make regular cash distributions of profits to their beneficiaries, your principal investment will be off limits during that time.

That your capital is illiquid can be viewed as a fixed cost of investing in real estate with a DST; how risky this illiquidity is, however, depends on each investor’s particular financial situation. The risk of illiquidity is just that you may later want to access the funds you invest; this will vary from investor to investor.

MANAGEMENT RISKS

With a DST-structured investment, what you gain in freedom from property management you lose in freedom to participate in management.

As a beneficiary rather than a trustee, you typically will not be involved in the practical management or eventual sale of the trust’s properties. This means that you should be sure to find a trustworthy sponsor who has managed similar offerings in the past.

Which sponsor you work with matters.

Along these lines, you should look for a sponsor with a strong track record in executing such investments. A DST offering is only as good as its underlying properties: if you choose the wrong sponsor, you may be investing in properties which were bought at prices higher than comparable assets in similar markets. In addition to evaluating the due diligence materials provided by sponsors, you should ask for and evaluate the past performance of DST offerings from that sponsor.

Another management-related risk which you should be aware of is that the interests of sponsors who offer DSTs can in principle diverge from your interests as an investor.

Even if a DST-structured investment offered by a sponsor fails to give investors a profitable yield, the sponsor still can collect fees for organizing the investment. Similarly, given other fiduciary duties which the sponsor may have, the sponsor could hold a property longer than what would be best for investors. These are further reasons to do a proper background check of your sponsor’s history. You not only need to look to see that they have handled similar deals in the past, but furthermore that those deals have actually met their projected return rates and didn’t run into problems due to careless management.

FINANCING RISKS

DSTs vary in how they are financed, ranging from all-cash investments to investments with loan-to-offerings (LTVs) of up to 80%.

Among DSTs that use leverage to increase cash flow to investors, some are interest-only and some are fully amortized, requiring that the loan be paid by the end of the holding period.

These different financing structures create different risks for investors.

Suppose that you own an investment property outright and you want to perform a 1031 exchange. If in completing this exchange you acquire a beneficial interest in a DST that uses leverage, you incur the risk that the lender could foreclose. And if the loan has a high ``loan-to-value’’, so that most of the value of the DST’s assets is paid for by the loan, vacancy or unforeseen costs can diminish investor cash flow.

For investors who may want to carry out a 1031 exchange in the future, the risk of defaulting on such a loan is particularly dangerous. Defaulting on the loan is one contingency that can cause the DST to convert to an LLC, jeopardizing the investor’s ability to execute future 1031 exchanges (as discussed below under “1031-Compatibility Risks”).

DST investments that use leverage to secure positive cash flow vary both in how much leverage they use and in the repayment terms of the loan used. Some are interest-only loans: for the holding period, the DST is only obligated to pay the interest on the loan. With such financing set up, the loan’s principal is to be repaid using the proceeds from the sale of the DST’s properties.

Alternatively, some loans used by DSTs are fully amortizing, so require that the loan in total be paid by the end of the holding period. This kind of financing can affect how reliably the DST can keep up cash distributions. With a fully amortizing loan, some of the DST’s income that otherwise would have flowed to the investor must be directed towards paying down the loan’s principal.

1031-ELIGIBILITY RISKS

Another kind of risk associated with DSTs is that although they can be used to facilitate a 1031 exchange, they must be structured in a particular way to do so.

Your DST needs to be managed in a particular way both so that your initial 1031 exchange will hold in the case of audit and to put you in a position to carry out future 1031 exchanges. So you should take care to verify that the DST offering you are interested in is carefully designed to facilitate your 1031 exchange and has a clear, prudent exit -strategy for when the investment wraps up.

By Delaware’s legislature’s design, DSTs are very flexible legal entities.

Delaware enacted the DSTA with the expressed aim of providing parties to a trust a high degree of freedom of contract. So, depending on how its forming documents are worded, for federal tax purposes a DST can either be treated as a grantor trust, or else as a partnership or a corporation.

In order for your beneficial interest in a DST to qualify for a 1031 exchange, it must be structured in a particular way which endows you with a beneficial interest in the property owned by the DST itself. Similarly, the way in which the holdings of the DST are arranged must satisfy several particular constraints given by Rev. Rul. 2004-86 for your interest to be eligible for a 1031 exchange. Not any DST-structured investment will give you the helpful tax benefits you may want.

In addition to the possibility of poorly organized DSTs which prevent investors from completing 1031 exchanges, there is a possibility that a DST may be managed in such a way that prevents investors from executing 1031 exchanges in the future. If all goes well with your DST investment, then you can perform a 1031 exchange after the DST’s holding period is over. The proceeds you would receive once the DST has disposed of its properties can be held by a Qualified Intermediary and used to acquire appropriate replacement properties (including further interests in another DST).

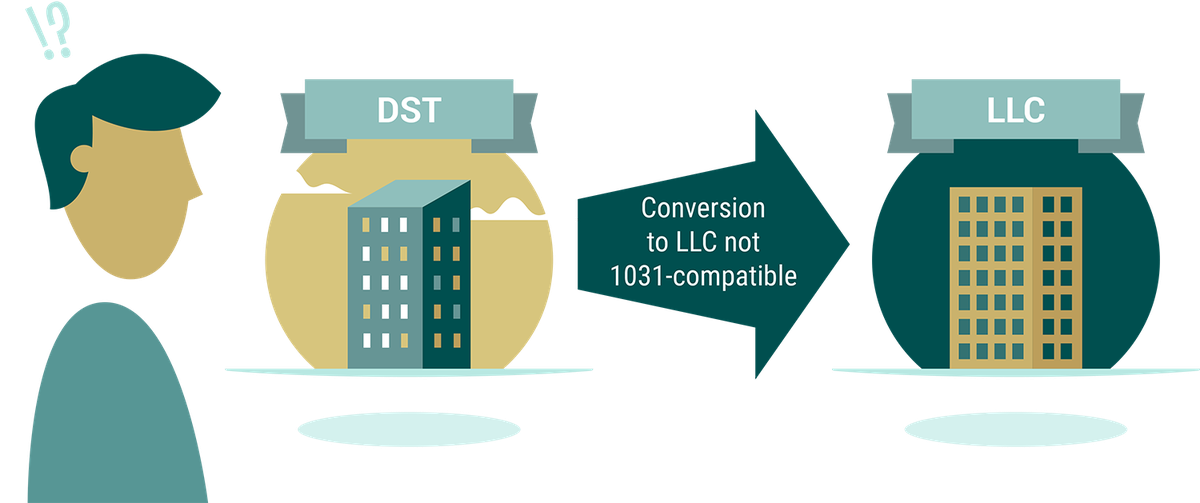

The possibility of exiting the DST investment using a 1031 exchange, however, is only possible if at the time the DST disposes of its properties you hold equitable title to those properties. You can fail to hold equitable title to the DST’s properties if the DST is converted into an LLC before its properties are sold.

A DST may convert to an LLC for various reasons: if there is a default on the loan used by the DST, if the DST’s properties have not been sold in a reasonable period of time, or if the trust’s expiration date is met.

Given the structural differences between DSTs and LLCs, holding an interest in an LLC does NOT constitute direct ownership of the LLCs underlying properties.

Although both LLCs and DSTs are “pass-through” entities for tax purposes, so that the investor is solely taxed on the legal entity’s income, it is only with a DST that the investor actually takes equitable title to the investment property.

For this reason, if your investment consists of interests in an LLC when you receive back your investment capital, the assets you thereby relinquish won’t count as “like kind” with real property you may later purchase with those funds.

In the event of such an LLC conversion, you won’t be eligible for a 1031 exchange going forward, and the capital gains which you have deferred up to that point will be realized, and you will owe capital gains taxes.

DSTs provide a useful way of structuring real estate investments, but whether it is a good idea to acquire a beneficial interest in a DST ultimately depends on what properties the DST’s sponsor has acquired, at what cost, via what financing, and within what broader economic market.

Just because a bunch of properties are thrown into a DST doesn’t make acquiring an interest in that DST a good investment. Although DSTs can be used to provide unique benefits and mitigate some of the risks associated with real estate investing, they introduce their own risks, and can’t completely eliminate the others.

Chapter 4

The Growing DST Market

Other benefits of the DST exchange strategy worth mentioning have less to do with the legal particulars of DSTs and more to do with the growing market of DST-structured real estate investments.

With the increased popularity of DSTs as investment vehicles, there is a wide range of 1031 sponsors who specialize in different asset classes, geographies, and debt structures. This selection of offerings gives you access to greater possibilities for diversification, designed according to the investment strategies of real estate professionals. This itself is a bonus which you wouldn’t benefit from were you simply wading as a sole owner into the traditional real estate market.

The particular way that DST-structured investments are typically put together also provides flexibility in timing, which is important given the strict deadlines involved in 1031 exchanges.

First, unlike closing escrow on a typical replacement property, which can take multiple months, identifying and closing escrow on DST interests can take as few as two or three days. DST interests can also be identified as “backup” investments according to the 1031 identification rules, so if your first choice of replacement property falls through, you won’t fumble your exchange.

The DST exchange strategy therefore can give you greater freedom to select an investment opportunity which works best for you, rather than leaving you to settle for a more time-costly option which looks good enough in the moment.

Second, since DSTs typically are used to invest in millions of dollars’ worth of real estate, such offerings can stay open to new investors up to a year. So, if you like a DST offering, you don’t have to feel rushed to invest in it before someone else gets there first.

Finally, DST sponsors are held to strict disclosure requirements and must provide extensive access to their due diligence and underwriting on the real estate they are offering with the DST. Given this, you can access the sponsor’s appraisals, property condition reports, environmental reports, loan documents, and market underwriting data before making your investment decision.

Read Example DST Offering Documents

Chapter 5

The DST 1031 Exchange Strategy

DST 1031 EXCHANGE PROCESS

After relinquishing your original property, identify promising DST offerings

Acquire shares in one or more DST as “replacement properties”

Defer capital gains on the sale of your original property

Pass off management responsibilities to DST sponsor

Receive regular cash flow distributions from your DST’s profits

WHAT IS A DST 1031 EXCHANGE?

Like any other 1031 exchange, in a DST 1031 exchange a real estate investor exchanges their relinquished property for a replacement property. But instead of acquiring whole replacement properties by oneself, the investor acquires shares in a DST, which are viewed as “like kind” by the IRS. The investor thereby obtains an undivided interest in the assets held by the DST, which often can include multiple large, high-quality commercial real estate properties.

Once your original income-producing property has sold and the funds are being held by your Qualified Intermediary (QI), your 1031 exchange has begun. You now have 45 days to identify a suitable “like-kind” replacement.

After considering the various available options, your QI uses the proceeds from the sale of your property to purchase interests in one or more DSTs, under the IRS's 1031 replacement rules. By doing so, you can defer capital gains tax on the sale of your original property and come to own interests in large portfolios of commercial properties, which provide you with regular cash distributions.

If the properties in these portfolios appreciate, your investment capital grows accordingly while you enjoy the passive cash flow without any burdens of managing the portfolio's properties.

We've seen that this effective investment strategy is made possible due to general aspects of trusts, to particular ways that the trust structure has been regimented in Delaware Law, and to how DSTs relate more broadly to federal tax law and the U.S. real estate market.

Of course, despite these major reasons why DSTs are well-suited for large real estate investment offerings, there are particular risks associated with any kind of investment. DST-structured investments are no exception.

Just as it’s important to understand how the structure of DSTs give rise to beneficial features to investments which they are used to arrange, it’s important for investors to appreciate how the structure of DSTs also come with certain risky features. As always, you should consult your independent counsel regarding tax and legal matters in deciding which investment best satisfies your needs and goals.