2019 Economic Vulnerabilities: Part Three

Today’s economy is beset by late-in-the-cycle vulnerabilities. As both the domestic and global economies cool, good deals are harder to sift out.

The risk-to-reward relationship in both the equity and debt markets are unfavorable for investors. The cost of stock relative to a corporation's cash flow is nearing historic highs (see the first installment of this series ). Strong credit market sentiment is pumping trillions of debt into speculative, highly leveraged holdings (see: the second installment ). The principal contributors of an economic bubble (lax regulation, weak underwriting standards, wall street short-termism, leniency from rating agencies, and investor euphoria) are present, and the vital pace that the economy must maintain to keep the debt and equity bubbles from bursting is projected to slow by nearly every measure. Duke University’s Fuqua Business School reports that almost half (48.6%) of surveyed U.S. CFOs expect a recession by the end of 2019; a remarkable 86% expect a recession in 2020.

This final installment of the 2019 Economic Vulnerabilities blog will outline a proven strategy for commercial real estate (CRE) investors that is tax efficient, preserves capital and maintains income through the coming downturn.

Two Common Strategies for Enduring a Recession: Weather-the-Storm or Turn-to-Cash

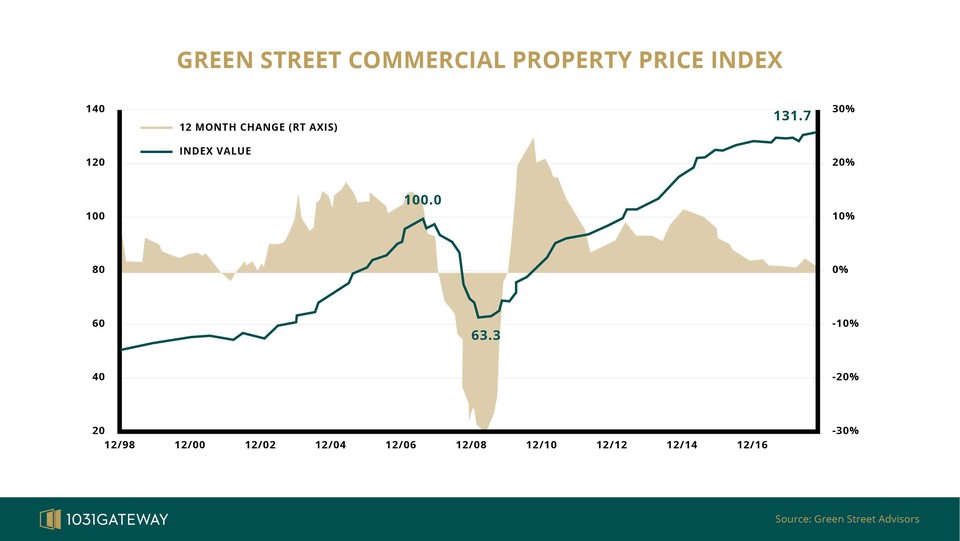

CRE investors can quickly recall the trauma of the 2008 Financial Crisis. Commercial real estate took a nosedive, losing 40% of its value .

News of another recession triggers the fight-or-flight instinct, reducing an investor’s options either to holding their position and weathering the storm or to selling and simply turning to cash. Both options leave money on the table.

A turn-to-cash investor might look at the above chart and decide that they don’t have the appetite for another ride on the downturn roller coaster. The investor might prudently see that the value of their property has soared, but that economic growth is slowing. Now might be the time to cash out and wait for the storm to pass.

While this strategy might circumvent the drama of watching their property’s value deteriorate, it has two disadvantages. First, the turn-to-cash investor loses the income that their asset was producing. Second, an exit without reinvestment in like-kind property means that a capital gains tax will take a big bite out of the sweet appreciation their asset has accrued.

(Just how big of a bite? Check out our Capital Gains Calculator to see what you would have to pay Uncle Sam to exit your investment.)

A weather-the-storm investor might look at the shortcomings of the turn-to-cash strategy and resolve to hold their position, believing that the real estate market will continue on a long-term uptrend. After all, doesn’t the above chart show that the value recovers within six years, and then rides the bull cycle up for another six? It’s nerve-racking, but for an investor who can endure with decreased income, their reward is avoiding a significant tax loss.

Although the weather-the-storm approach resolves the strategic shortcoming of a non-tax-efficient investment exit, it harbors the risk of an indefinite loss of income. Investors using a high level of leverage are at risk of defaulting if the rental income they rely on dries up. An investor who chooses the weather-the-storm strategy should conduct a thorough appraisal of what would happen if occupancy decreased or if significant discounts were required to keep tenants. The investment’s Debt Service Coverage Ratio should be carefully considered to see how close the investment is to the default line.

Both of the well-trodden strategies provide an investor with an advantage and some less-than-ideal downsides. The turn-to-cash strategy offers the security of locking in the value of their investment by liquidating the asset and holding cash, but the IRS takes a bite of the appreciation and the investor losses the property’s productive income. The weather-the-storm strategy avoids costly taxes, but a depressed economy and an uncertain decrease in cash flow can strain an investor’s balance sheet, potentially leading to bankruptcy.

Recession-Proof Real Estate: A Proven Strategy That Preserves Capital and Maintains Income Through a Downturn

Through an analysis of the last recession, our research turned up a strategy that provided CRE investors with the benefits of turn-to-cash and weather-the-storm, but without their downsides. The strategy: exit CRE investments that are susceptible to a recession near the height of the market and utilize a tax-efficient 1031 exchange to transition to a recession-proof real estate investment. This strategy offers investors a timely and tax-efficient exit to a stable income producing investment that can withstand a downturn.

Here's how the strategy works:

The 1031 exchange shelters an investor from having to pay costly taxes when transitioning to a new investment. Broadly speaking, when an investor reinvests proceeds from the sale of an investment property in another like-kind investment property, the IRS doesn’t require the investor to pay capital gains taxes on the appreciation of their relinquished property. For CRE investors, a "like-kind" property is one used strictly for business or investment purposes, as opposed to a personal residence. Additionally, the IRS extends what qualifies as like-kind beyond physical assets to include entities whose underlying collateral is commercial real estate and that pay-out a pro-rata portion of the investment’s income, such as a Delaware Statutory Trust or DST (What is a DST? Find out in our comprehensive DST Guide) . These terms for a 1031 exchange mean that a CRE investor can exit a single property (an apartment complex, for example) without paying a hefty capital gains tax and use the proceeds to purchase partial ownership shares in a DST that owns many properties.

A 1031 exchange into a DST accomplishes the goals of locking in the value of your property without the downside of a hefty capital gains tax. Additionally, a DST that contains multiple properties can increase the security of the investment with the added benefit of diversification. However, diversification alone does not make an investment impervious to a recession. Ultimately, the DSTs capacity for protecting capital and maintaining income through a recession depends on how its underlying collateral performs.

To understand what kind of property performs well through a recession (and by extension, to answer what properties should make up the holdings of a recession-proof DST), we looked through CoStar data from the last recession. Investments that could survive that downturn (the most significant financial crisis since the Great Depression) deserve the attention and consideration of CRE investors. What we found was a class of CRE properties with extraordinary resilience because of three characteristics: a (1) long-term lease on (2) net-lease terms, which had been (3) financially guaranteed by investment-grade corporations. I’ll refer to this class of investment as LT/NL/IG .

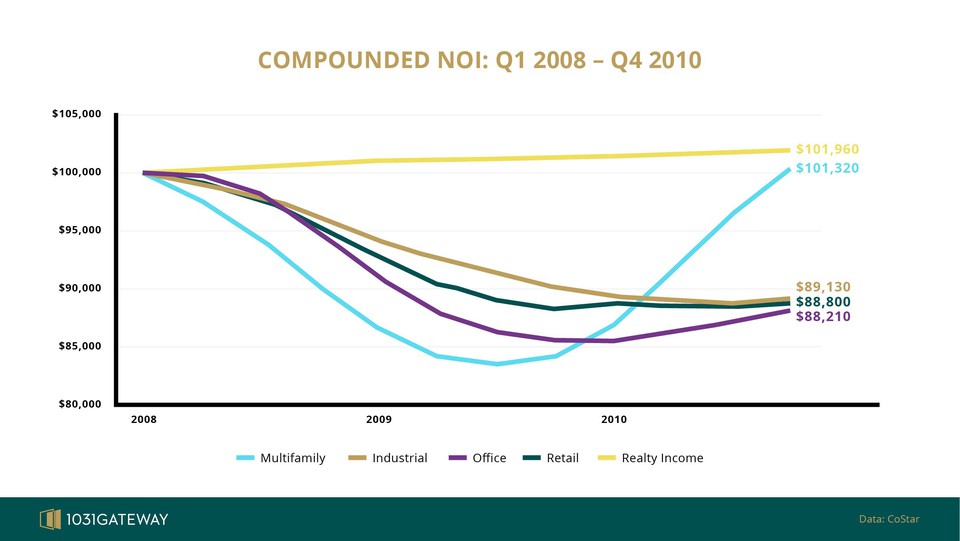

The graph below charts the compounded NOI of each primary income producing real estate sector and the performance of a LT/NL/IG portfolio (represented by Realty Income) through the last recession:

Set against the backdrop of this seemingly all-encompassing market downturn, the Realty Income (LT/NL/IG) assets provided stable NOI through the recession!

What is it about these three qualities that create such exceptional income stability and capital preservation for real estate investors?

Long-term leases provide investors with what they need most during a downturn: time.

During a recession, an expired lease provides the tenant a legal right to negotiate a much lower rent or not renew. If not set long-term, the lease might expire during a decline, which would leave the investor’s income vulnerable to the market’s downward swing. With a long-term lease, a property owner can bridge a recession with a tenant locked into a long-term (10+ years) lease. These leases might also include a rent escalator, which is the reason we see an increase in NOI for the LT/NL/IG properties in the chart above.

Net-lease terms place many of the responsibilities associated with maintaining a property on the tenant.

Based on the kind of net-lease, it could place the responsibility for structural maintenance, taxes, and insurance on the tenant rather than the owner. Double net-lease places the burden of tax and insurance on the tenant; triple-net places those responsibilities and structural maintenance on the tenant. A net-lease contract eliminates these liabilities, decreasing the risk of getting overextended if business slows and an untimely and costly piece of maintenance is required.

Investment-grade corporations are more likely to have the financial wherewithal to endure a recession.

An investor might have a long-term lease with great terms, but if their tenant’s business buckles under the pressure of a recession, the investor will lose their income and be swept into the downturn in search of a new tenant. When an investment-grade corporation has guaranteed payment on a tenant’s lease, the investor can have a much higher sense of security that the rent will be paid even in weak economic conditions.

Our Recommendation

With the economy slowing, indicators of a future recession compiling, and market liquidity drying, now is the time to choose and execute a strategy for dealing with the next downturn.

History has shown us that owners of commercial real estate with a long-term lease on net-lease terms with investment-grade tenants are able to preserve both their capital and income through a recession. A DST comprising LT/NL/IG properties will add even greater security through multi-property diversification, while also being 1031 exchange eligible.

For CRE investors, 1031Gateway’s recommendation for protecting capital and maintaining income is to execute a 1031 exchange into a DST comprised of LT/NL/IG properties.